Top 10 Most Valuable Cryptocurrencies by Market Cap

The cryptocurrency market has matured significantly over the past decade, evolving from a niche technology experiment into a multi-trillion-dollar global financial ecosystem. Today, the top 10 valuable cryptocurrencies are not just digital tokens — they represent the leading forces shaping blockchain adoption, decentralized finance, and even regulatory discussions worldwide. These assets hold billions in market capitalization, attract millions of users, and often serve as benchmarks for the health and sentiment of the broader crypto market.

This ranking, updated as of August 7, 2025, reflects the assets with the highest market value based on circulating supply and current prices. While market caps can fluctuate daily, these coins have consistently demonstrated resilience, utility, and strong community or institutional support.

1. Bitcoin (BTC) – The Pioneer of Digital Assets

Source: Investopedia

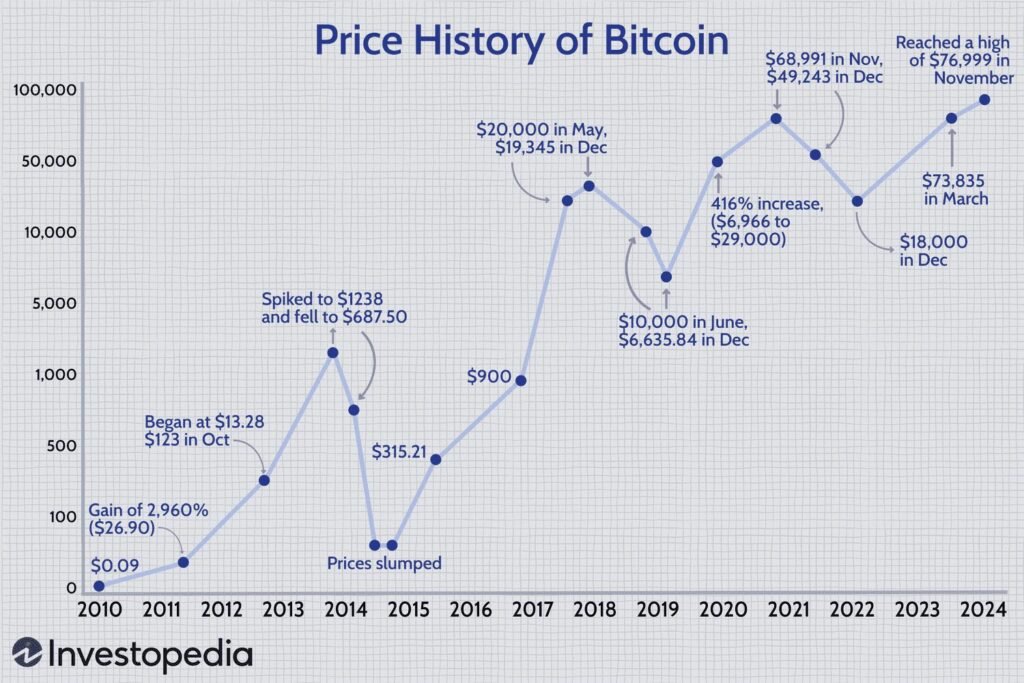

Bitcoin remains the undisputed leader in cryptocurrency, commanding a market capitalization of over $2 trillion. Often called “digital gold,” it serves as both a store of value and a medium for peer-to-peer transactions without the need for intermediaries. Its fixed supply of 21 million coins creates inherent scarcity, a feature that continues to drive demand among both retail and institutional investors.

As of August 7, 2025, Bitcoin trades at $101,732.17. Despite market cycles marked by steep rises and corrections, BTC has proven remarkably resilient, rebounding from multiple downturns and maintaining investor trust. Many now see it not just as a speculative asset, but as a long-term hedge against inflation and a fundamental part of diversified investment portfolios.

2. Ethereum (ETH) – Smart Contract Powerhouse

Ethereum firmly holds its position as the second-largest cryptocurrency by market cap, valued at roughly $500 billion. Priced at $2,248.43, it underpins a massive network of decentralized applications, decentralized finance (DeFi) platforms, and the non-fungible token (NFT) market. The introduction of Ethereum 2.0 and its shift to a Proof-of-Stake consensus mechanism significantly improved scalability and energy efficiency, paving the way for broader adoption.

Its vast developer community and continuous innovation ensure Ethereum remains a critical platform in blockchain technology. Whether powering complex DeFi protocols or digital art marketplaces, ETH remains at the heart of the decentralized internet.

3. Tether (USDT) – The Stability Anchor

Source: digwatch

Tether stands as the most widely used stablecoin, maintaining a consistent 1:1 peg to the U.S. dollar. This stability makes it an indispensable tool for traders seeking to protect themselves from the cryptocurrency market’s notorious volatility. With a market cap exceeding $120 billion, USDT is also heavily used for cross-border payments and as a liquidity anchor in the crypto ecosystem.

Its ease of use and high liquidity on virtually every crypto exchange allow Tether to facilitate billions of dollars in daily trading volume. While it has faced scrutiny regarding reserve transparency, it continues to dominate the stablecoin sector.

4. XRP (Ripple) – Fast, Low-Cost Global Payments

Source: Coinpedia

XRP, developed by Ripple Labs, has built its reputation as a solution for rapid, low-cost international money transfers. Trading at $2.30 and boasting a market cap above $120 billion, it offers settlement times measured in seconds, making it attractive for banks and payment providers worldwide.

The cryptocurrency’s adoption has grown in the wake of partial legal clarity in the United States, reigniting institutional interest. In many developing economies where remittance costs are high, XRP’s efficiency offers a compelling alternative to traditional channels.

5. BNB (Binance Coin) – Expanding Utility Beyond Exchange Fees

BNB began its journey as a token to provide discounted trading fees on the Binance exchange. Over time, it has evolved into a versatile asset used across the Binance Smart Chain for transaction fees, DeFi applications, and NFT purchases. Currently priced at $622.69 with a market cap exceeding $95 billion, BNB has firmly established itself as a core asset in the crypto economy.

Its integration into a thriving ecosystem of decentralized apps and blockchain-based services has helped it maintain relevance beyond just exchange utility, making it a staple in many investors’ portfolios.

6. Solana (SOL) – High-Speed Blockchain for Web3

Source: Atomic wallet

Solana’s biggest strength lies in its high transaction throughput and ultra-low fees, enabling it to process thousands of transactions per second. This performance has made it a popular choice for gaming platforms, NFT marketplaces, and DeFi protocols. At $134.69 per token and a market cap around $65 billion, Solana continues to draw both developers and users to its fast-growing ecosystem.

While it has faced criticism for occasional network outages in the past, recent infrastructure improvements have stabilized performance. The result is renewed investor confidence and a steady increase in active projects.

7. USD Coin (USDC) – Regulated and Transparent Stablecoin

Source: Beincrypto

USD Coin offers a fully backed, regulated alternative in the stablecoin market. Issued by Circle and pegged to the U.S. dollar, USDC emphasizes transparency, with regular audits to verify its reserves. With a market cap of around $55 billion, it has become a go-to asset for DeFi collateral, cross-border payments, and stable on-chain transactions.

Its integration into major payment systems and wallets strengthens the bridge between traditional finance and blockchain, making it a trusted choice for both individuals and institutions.

8. Top 10 Valuable Cryptocurrencies : TRON (TRX) – Driving Web3 Content and Stablecoin Transfers

TRON focuses on decentralized content sharing and Web3 infrastructure, offering an efficient, low-cost blockchain network. Its popularity in Asia is largely due to its heavy usage for stablecoin transactions, particularly USDT transfers. Trading at around $0.134 with a market cap near $12 billion, TRON maintains one of the highest transaction volumes in the industry.

Its expansion into decentralized applications and partnerships with content platforms further solidifies its role in the blockchain economy.

9. Top 10 Valuable Cryptocurrencies : Dogecoin (DOGE) – From Meme to Mainstream

Source: X

Initially created as a lighthearted parody of Bitcoin, Dogecoin has developed into a cryptocurrency with real-world uses in tipping, microtransactions, and community-driven fundraising. Priced at $0.1544 and valued at roughly $22 billion, DOGE benefits from a strong and active community, as well as periodic endorsements from high-profile figures.

Its longevity in the market is a testament to the power of community support in the crypto world, even in the face of newer competitors.

10. Cardano (ADA) – Top 10 Valuable Cryptocurrencies – A Research-First Approach to Blockchain

Source: Flipster

Cardano stands out for its academic approach to blockchain design, focusing on sustainability, scalability, and interoperability. Using a Proof-of-Stake consensus mechanism, it operates with one of the lowest energy footprints among major blockchains. At $0.5491 and a market cap of around $19 billion, ADA powers a growing number of decentralized applications and partnerships in sectors like education and agriculture.

Its slow but deliberate development cycle has earned it a reputation for reliability and long-term vision.

Final Thoughts – Top 10 Valuable Cryptocurrencies

The top 10 valuable cryptocurrencies in 2025 showcase the breadth and diversity of the digital asset landscape. From Bitcoin’s dominance as a store of value to Solana’s performance-driven blockchain and the critical role of stablecoins like USDT and USDC, each coin offers something unique to the market. Together, they form the foundation of a rapidly evolving financial ecosystem that continues to push the boundaries of what money, contracts, and digital ownership can be.

For investors and observers alike, understanding market cap rankings is more than just a numbers game — it’s a way to track which technologies and communities are driving the next wave of innovation in global finance.